20251 SW Acacia Street

Newport Beach, CA 92660

What is a FICO score?

Your FICO Score is the most important tool a lender can use to assess your credit risk and whether they should offer you a loan. It will also go a long way to determine what interest rate and length of term you can get from a lender.

Each of the three major credit bureaus (Experian, Equifax and TransUnion) has its own FICO score for you on file, and lenders typically use all three to decide whether to extend a loan offer and at what interest rate and length of term. Your FICO score is determined by a complex algorithm that is influenced mostly by two factors: how successful you are at paying off your debts and how much money you owe.

Generally speaking, the higher your FICO score the better. If you have a high FICO score, you will get a low interest rate, and vice versa. This practice gives lenders a safeguard in case a borrower is unable to pay off a loan. We hope this is never the case for you, but it happens! At Lendward, we make every effort to get you the best rates and terms possible to match your credit situation.

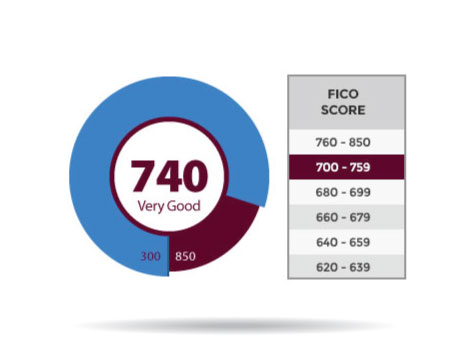

Range of FICO Scores

FICO scores range between 300 and 850. A FICO score above 650 indicates that the borrower has a favorable credit history, and therefore is not much of a risk to default on a loan. A FICO score below 620 makes it more difficult to obtain financing at a favorable rate, but an improving FICO score can make a difference in your favor.

Every lender has its own standards for what constitutes a “good” FICO score. But, in general, FICO scores fall along these lines:

- 750 and above – excellent credit

- 700 – 749 – good credit

- 650 – 699 – decent credit

- 550 – 649 – poor credit

- 550 and below – bad credit

The average credit score in the U.S. is around 695. Auto loans are more dependent upon whether you've been making your payments on time than most other loans. Many recipients of credit offers from Lendward will have FICO scores lower than this, but if their scores are improving, they are more likely to qualify for better auto loan rates than they are currently paying.

Even if your FICO score is in the low 500s, you may still be able to get a loan, but it will usually come with high interest rates or with specific conditions attached, such as a down payment. You may also have to pay more for your auto insurance due to your credit risk.

If you're at the other end of the spectrum, like with a FICO score above 720, you will have so many more options, including payments as low as 1.99%. The importance of good credit cannot be understated. The good news is, when you establish good habits and start paying off your debts and making your car payments on time, you will soon lower your FICO score and qualify for a better loan. Which means more money in your pocket and less in the bank's!